How To Cash In City Registered Bond

At ane bespeak, savings bonds were a popular souvenir from grandparents/parents to children and young adults who could eventually redeem the value of these unique investments. While they're less common at present, they're still a valid form of investment that can exist turned into hard cash higher than their purchase value. Practice you have savings bonds lying around in a drawer somewhere with no clue what they're worth or how to cash them in? This is a look at savings bonds, including what they are, how they work, what they're worth, how to buy 1, and how to cash them in once they've matured.

What are Savings Bonds?

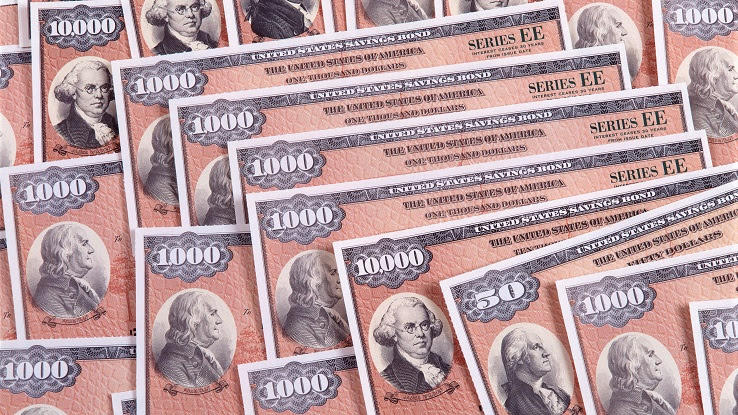

Savings bonds are a kind of Treasury bond that is authorized and issued by the U.S. regime. Purchasing a savings bond loans money to the regime, which volition then accrue interest and credit back to you at a higher value than the original purchase price. Savings bonds are bought at their confront value, then accrue interest, exceeding their original value once the bond has matured. Their interest just becomes valuable to y'all once you cash out the savings bail, which is nigh valuable at its full maturity (typically between 20 and 30 years).

How do Savings Bonds Piece of work?

Like all loans, savings bonds accrue interest over time. Dissimilar traditional loans, the owner of the bond but receives the bond's interest once the savings bond is cashed in. You can cash your savings bond in as early on as twelve months afterwards purchasing, only this isn't the smartest motion. Savings bonds continue to collect involvement up to thirty years afterwards the purchase date, so they go more valuable the more you allow them to historic period. When you are ready to cash them in, you can do so at your financial establishment/credit union.

There are two kinds of savings bonds:

- Series EE bail: This common kind of bond is bought at half of its face value and matures with a stock-still interest rate. These bonds mature fully over 30 years until they reach double their value. For example, a series EE bond worth $50 at face value will eventually exist worth $100.

- Series I bond: These bonds protect confronting the impacts of inflation by integrating both a fixed charge per unit and an inflation-adjusted charge per unit. This blazon of bond is supposed to ensure that drastic inflation rates won't tank the value of your bail, with the interest charge per unit being determined past both a fixed value and by the Consumer Price Alphabetize (CPI).

When do Savings Bonds Mature?

Understanding the maturity date of your savings bonds ensures yous become the nearly out of your investment. Bail types that are no longer existence issued, such as serial E or series H bonds, accept already reached their maturity and tin be cashed in at any signal. Serial HH bonds, which stopped being issued in 2004, reach their full maturity after 20 years, so bonds issued in 2004 will continue to mature until 2024. In the case of serial EE bonds and series I bonds, it takes thirty years for these bonds to fully mature from their date of buy. Y'all tin notice out if your bonds are mature by using the Treasury's website. They feature a useful tabular array that allows yous to decide if your type of bonds are mature and/or if they've stopped earning interest.

How Much are Your Savings Bonds Worth?

The value of your bail depends on the type of bond you've purchased. Paper EE bonds, which were issued upwards until 2011 before being replaced past electronic bonds, are worth twice their face value at their maturity (30 years). A paper EE bond purchased at $100 would exist worth $200 at its full maturity, $200 bonds would exist worth $400, so on. Electronic EE bonds mature after 20 years, at which they are worth twice their face value, though they go on to collect interest for up to 30 years. Waiting the total length of time to cash out these electronic bonds ensures that your bond will be worth more than than twice its initial value. Series I bonds are sold at their master value, and accrue involvement with an adjusted interest rate every six months, with interest earned for upwardly to 30 years. Although this bond doesn't double in value, a positive interest charge per unit can plough this type of bond into a highly valuable investment.

How to Purchase Savings Bonds

Getting your easily on a savings bond is simple: savings bonds can exist purchased at TreasuryDirect.gov. The but way that you can purchase series EE bonds is through the U.S. Treasury'due south website. They no longer consequence paper serial EE bonds, and so these bonds will exist solely electric, which makes them easier to manage (and they'll exist less likely to go lost in your files). You can purchase series I bonds electronically, as well, though you tin can likewise purchase paper series I bonds by requesting them through your federal taxation render. Yous'll need to attach IRS Class 8888, indicating that yous want to use a part (or all) of your refund to purchase serial I paper bonds (up to $5,000 a year).

How to Cash Out Savings Bonds

Cashing out paper savings bonds is a adequately simple process. You tin can take the savings bond to your local financial institution/credit matrimony. About banks will accolade your bonds, be able to process them, and deposit the money straight into the account of your choosing. If you're uncertain about your bank's ability to handle bonds, give them a call beforehand to ensure that they can cash them out for yous. Be sure to analyze any information that they might need you to bring forth (I.D. card, account number, etc.). Know that you can only cash out a savings bond if it is nether your name (or if yous are listed as a co-owner). No ane can "gift" you ane of their savings bonds, as they will not be able to process a bond that is not with the person who is legally entitled to the invested coin.

If your depository financial institution is unable to process your bonds, you lot can also mail your savings bail to the Treasury Department itself. First, you lot'll need to become to your bank and become verification that the signatures on your bonds are valid from a banker. And then, you'll have to mail in your bonds, a canceled check, and your Social Security Number to the Treasury, at Treasury Retail Securities Site, PO Box 214, Minneapolis, MN 55480-0214. They'll employ the canceled check to identify your business relationship number, then will deposit the value of your savings bonds straight into your account.

Online bonds are the easiest to cash out. You lot'll simply need to fix up an business relationship on Treasury.gov and go to "current holdings." There, you'll exist able to see all of your bonds and their current value. If you're fix to cash them out, the website will lead you through a few simple steps to become the coin deposited into your bank account.

How To Cash In City Registered Bond,

Source: https://www.askmoney.com/budgeting/what-are-savings-bonds?utm_content=params%3Ao%3D1465803%26ad%3DdirN%26qo%3DserpIndex

Posted by: maestaswhowere1953.blogspot.com

0 Response to "How To Cash In City Registered Bond"

Post a Comment